Sending a significant amount of money to a company thousands of miles away can be one of the most stressful parts of importing. Understanding the mechanisms and risks of different payment methods is essential to protecting your investment.

When sourcing from Vietnam, you will almost always encounter two primary payment terms: T/T (Telegraphic Transfer) and L/C (Letter of Credit). Here’s what you need to know.

T/T (Telegraphic Transfer): The Standard Method

T/T is a direct bank transfer from your account to the supplier’s account. It is the most common payment method for small and medium-sized businesses due to its simplicity and lower bank fees.

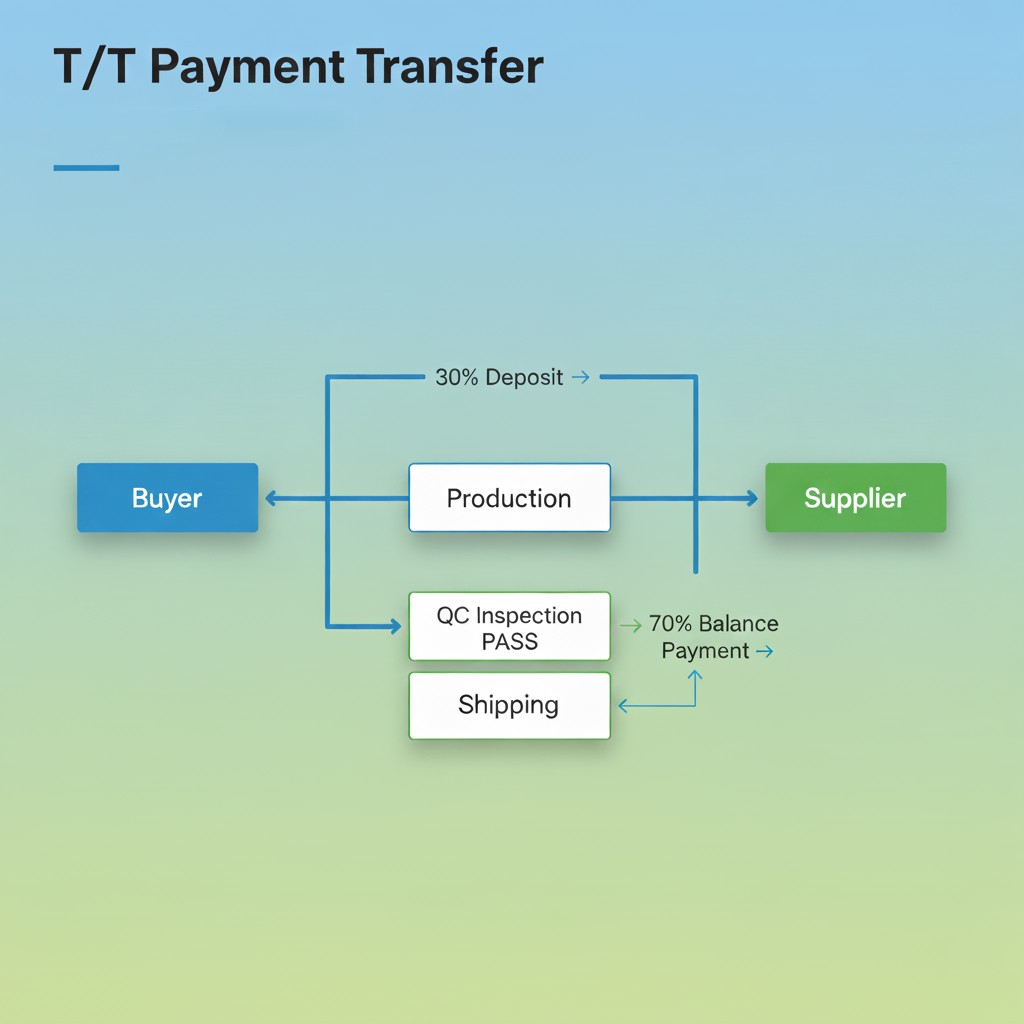

A T/T payment is typically split into two parts:

- Deposit (30-50%): You pay this upfront to allow the supplier to purchase raw materials and begin production.

- Balance Payment (50-70%): You pay the remaining amount at a later, agreed-upon milestone.

The key is when you pay the balance. The biggest risk for a buyer is paying the balance before the goods have been inspected for quality. A common mistake is paying the balance upon presentation of a copy of the Bill of Lading (B/L), which proves the goods have shipped, but says nothing about their quality.

Best Practice: The safest approach is to make the balance payment after you have received a passing Pre-Shipment Inspection (PSI) report from your on-site QC team or sourcing agent. This gives you leverage to have any quality issues fixed before you release the final payment.

L/C (Letter of Credit): The Secure Method

An L/C is a more formal and secure payment method, typically used for very large orders (e.g., over $50,000). It is essentially a guarantee from a bank that the supplier will receive their payment, but only if they meet a very specific set of documentary conditions.

How it works: Your bank issues an L/C to the supplier’s bank. The supplier can only “cash in” the L/C and receive payment by presenting a list of required documents, such as a commercial invoice, a packing list, an original Bill of Lading, and, crucially, a certificate of inspection.

Pros:

- High Security: You don’t pay until the supplier proves they have met all the contractual obligations. It provides strong protection against scams.

Cons:

- Complex & Slow: Setting up an L/C involves a lot of paperwork and can take weeks.

- Expensive: Bank fees for an L/C are significantly higher than for a T/T.

- Less Attractive to Suppliers: Many small or medium-sized suppliers in Vietnam may be unfamiliar with L/Cs or prefer the simplicity of T/T.

Tying your final payment to a successful Pre-Shipment Inspection report is the single best way to protect your investment. A professional sourcing agent manages this critical step, ensuring an independent quality report is in your hands before you authorize the final release of funds.

Choose the Right Tool for the Job

For most SMEs starting out in Vietnam, T/T is the standard method. The key to using it safely is not the method itself, but the timing. By making the balance payment conditional on a successful, independent quality inspection, you can mitigate most of the associated risks. As your orders grow larger, exploring the security of an L/C becomes a more viable option.

Protect your payments. Learn how EQSource’s integrated QC inspection and payment advisory services can secure your investment and provide peace of mind.